The Company has been striving to achieve good corporate governance which is the system of rules, processes and practices that the Company is managed and overseen for the purpose of balancing the interests of shareholders, the community and other stakeholders. Good corporate governance could contribute to long- term success and sustainability of the Company.

Throughout FY2025, the Company has complied with all the applicable code provisions under the Corporate Governance Code (the “CG Code”) as contained in Appendix C1 of the Listing Rules which reflects that the Company has committed to applying the principles of good corporate governance (the “Principles”). Such application of the Principles could also be illustrated from the disclosure of the Company’s corporate purpose, core values, strategy and their alignment with culture and governance, board composition and nomination, directors’ responsibilities, delegation and board proceedings, audit, internal control and risk management, remuneration and shareholders engagement.

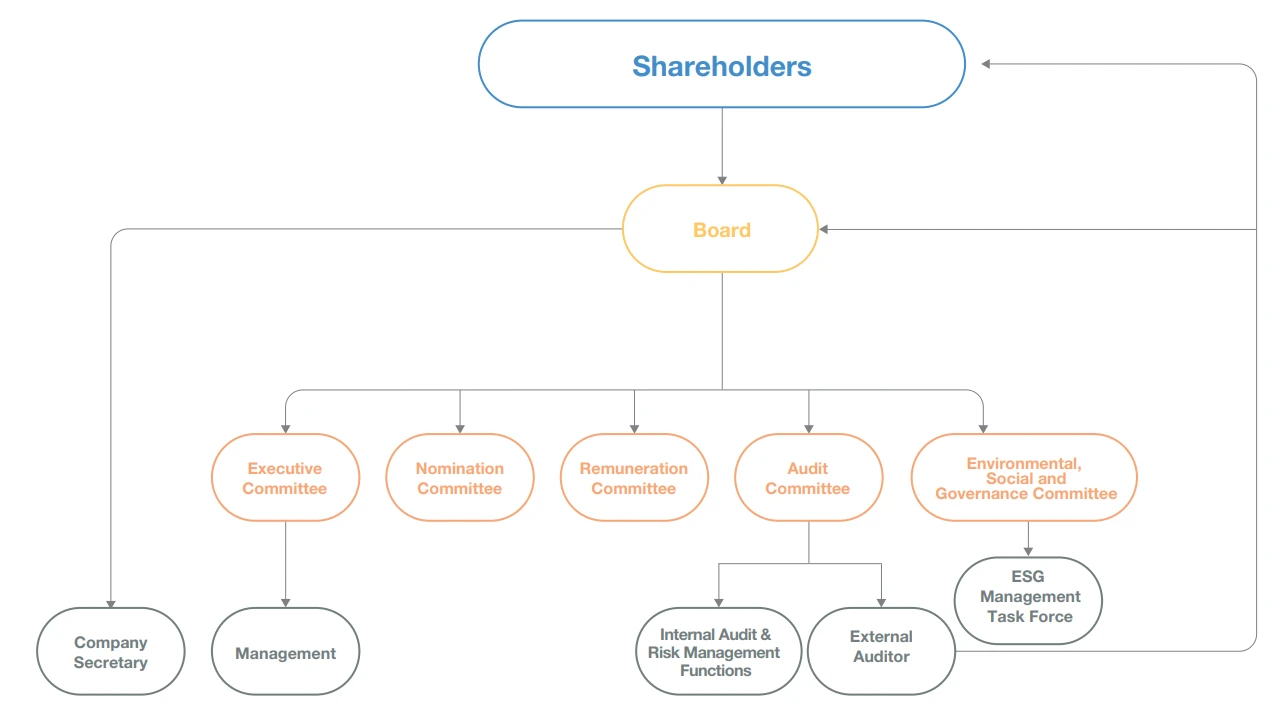

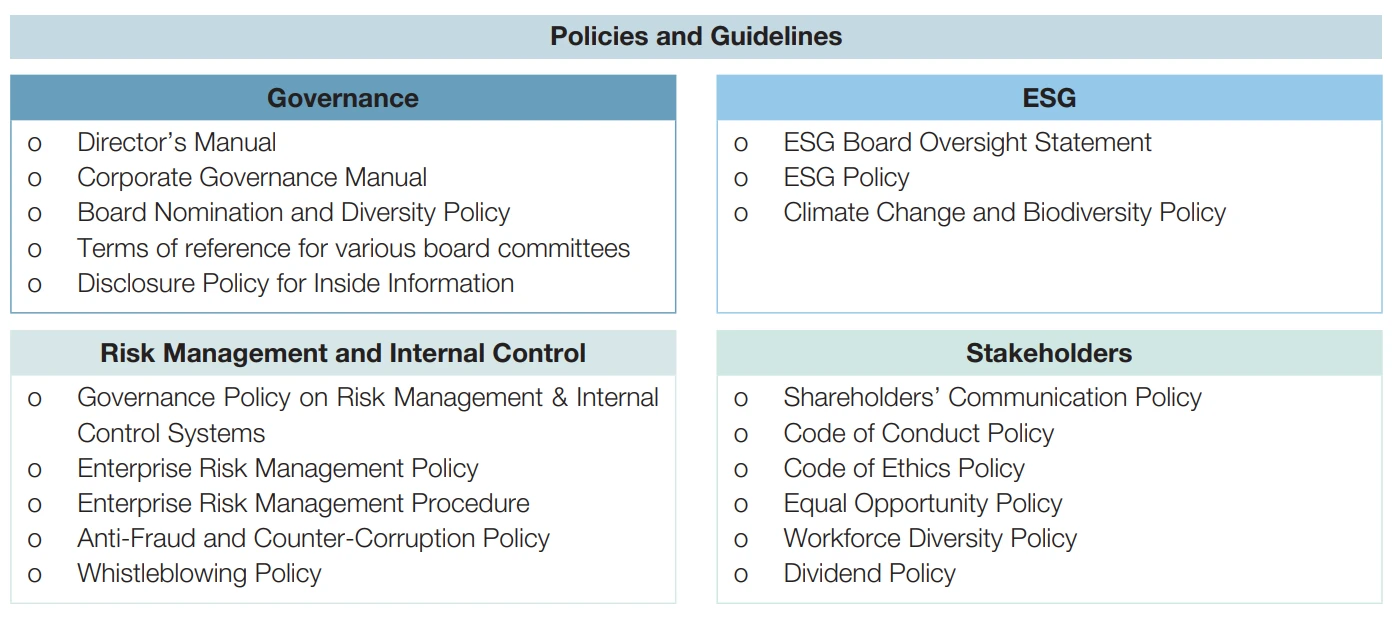

This framework is designed with reference to the applicable legislations and Listing Rules, and is backboned by a collection of guidelines, policies and procedures formulated by the Board. The Board and/or the relevant board committees conducted regular review of, and as appropriate, updates to the guidelines, policies and procedures due to changes in applicable legislations and Listing Rules, external environment, market practices and/or internal requirements.

- For the purpose of enabling long term success of the Group and enhancing shareholder value, the Board develops the culture, sets the overall strategy and directs the affairs of the Group, as well as supervises management and ensures good corporate governance policies and practices are implemented within the Group.

- In the course of discharging its duties, the Board acts with integrity and in good faith, with due diligence and care, and in the best interests of the Company and its shareholders as a whole.

- The Board is responsible for performing the corporate governance duties. Specific terms of reference are set out in the Corporate Governance Manual of the Company and the relevant duties include::

(a) to develop and review the Company’s policies and practices on corporate governance;

(b) to review and monitor the training and continuous professional development of directors and senior management;

(c) to review and monitor the Company’s policies and practices on compliance with legal and regulatory requirements;

(d) to develop, review and monitor the code of conduct and compliance manual (if any) applicable to employees and directors; and

(e) to review the Company’s compliance with the CG Code and disclosures in the Corporate Governance Report.

- Day-to-day operation of the businesses of the Company is delegated to the management which is led by the Executive Committee. The management is closely monitored by the Board and is accountable for the performance of the Company as measured against the corporate goals and business targets set by the Board.

- The Board carries out certain of its oversight responsibilities through its committees, allowing more in depth attention devoted to overseeing key issues.

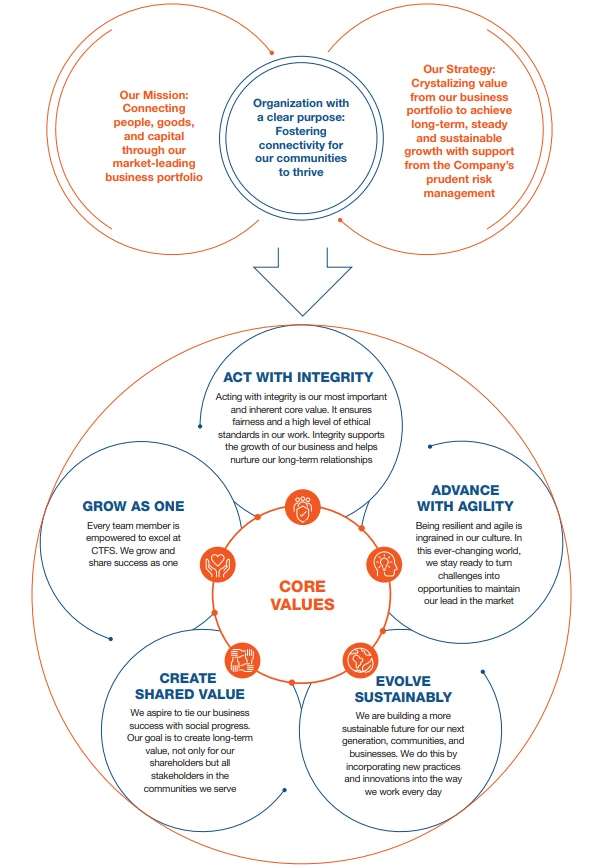

Act with Integrity

- The Company is committed to upholding the highest standards of integrity. Our core value of acting with integrity guides the decisions, actions and behaviours throughout the organization and lays down the foundation for the way in which we conduct our business. Directors, management and other employees are required to act lawfully, ethically and responsibly. To this end, various policies, guidelines, controls and systems have been established and updated from time to time in light of the evolving regulatory landscape, including but not limited to, “Code of Conduct Policy”, “Code of Ethics Policy” and “Employee Grievance Policy” in the “Employee Handbook”, “Anti-Fraud and Counter-Corruption Policy”, “Conflict of Interest Policy” and “Whistleblowing Policy”. During FY2025, anti-corruption training session had been provided to the directors and staff of the Company. “Whistleblowing Policy” continues to provide channels for employees and external parties to raise concerns in confidence. Please refer to the ESG report which contains our other measures in relation to this core value. All the above enhances the established practice of acting with integrity of our directors and staff.

Grow as One

- It is our belief for the Company and its staff to grow as one, through programs and measures to fostering growth and promoting well-being of our staff, and enhancing their sense of belonging as an important part of building a strong culture to ensure that our leadership team possesses the appropriate skills and traits. We seek to invest in leadership development through one-on-one coaching or group workshop to enhance management capability. Our efforts for promoting the core value of “Grow as One” are set out in our ESG report.

Advance with Agility

- In face of the rapidly changing economic, social, geopolitical and regulatory landscape, we remain agile to address the challenges ahead with the aim of mitigating risk associated therewith and leverage on opportunities arising therefrom. For the purpose of updating our directors on the opportunities and challenges of our business segments, business briefing sessions were conducted to facilitate directors’ interaction with senior management and discharge of directors’ oversight responsibilities. In line with our core value “Advance with Agility”, we have also taken proactive approaches in sustainability financing as well as incorporated ESG due diligence evaluation process in our investment analysis and decision making process. Please refer to our ESG report which describes our efforts, measures and actions in relation to this core value.

Create Shared Value

- The core value “Create Shared Value” represents our efforts in promoting economic growth and societal advancement and is reflected in our collaboration with suppliers, business partners, local communities and customers along our value chain. Among the aforesaid efforts, the collaborations with local communities involved our charity foundation and volunteer alliance which aim to focus on “Empower for change”, “Build for Support” and “Drive for the Future” for the purpose of creating positive impact on the society. Please find further information in relation to this core value in our ESG report.

Evolve Sustainably

- It is expected from all stakeholders that substantial efforts shall be placed on the initiatives which lead to positive environmental change and full compliance with the relevant regulations. The core value “Evolve Sustainably” involved on the part of the Company’s attempts to strive for continuous improvement and to drive operational optimization and product excellence. Such attempts had been embedded in our belief as well as in operations of various businesses and segments. As a highlight, “Evolve Conference 2025” offered valuable opportunities to share insights on innovative sustainability practice with management and different business units and Mini Fireside Chats had helped staff to enhance awareness in various ESG aspects. Please find in our ESG report the relevant measures and disclosures relating to this core value.

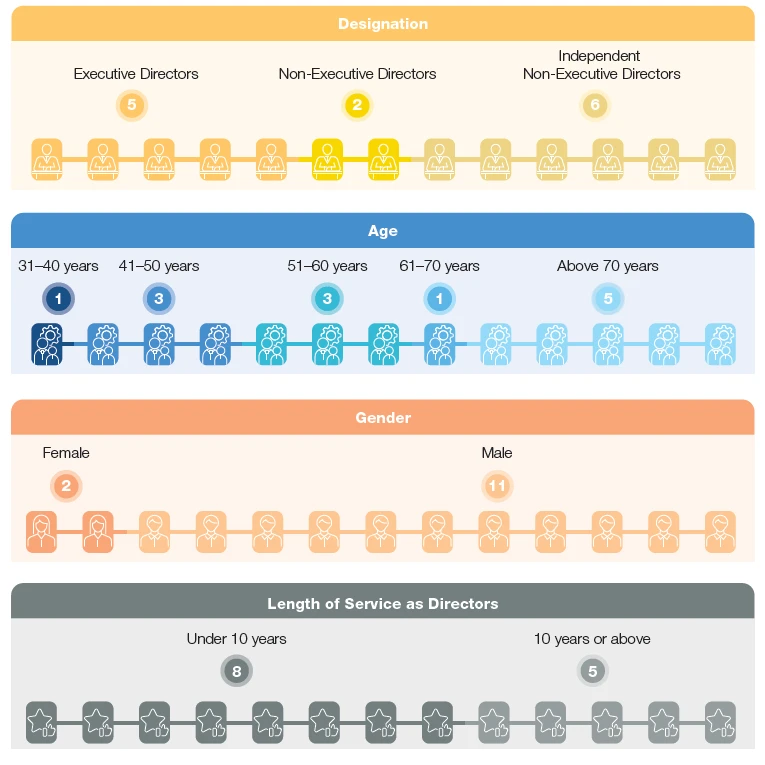

Board Diversity

- Our Board has a balance of tenure, diversity and age, with an effective mix of experience and fresh perspective. The following and the section “Board Expertise” illustrate the diversity profile of the Board members as at the date of this report:

- When considering new or replacement appointment of Board members, we might seek appropriate candidates to enhance gender diversity of our Board. Following the change of board composition during FY2025, the proportion of female representation at board level has been increased from 14% to 15%. We are committed to maintaining board representation by director(s) of each gender to be no less than 10%.

Board Expertise

- Our directors bring varying perspectives to the Board based on their distinct backgrounds and experience. The table below highlights the attributes of our directors, whose capability aligns with the scale, complexity and strategic positioning of our business:

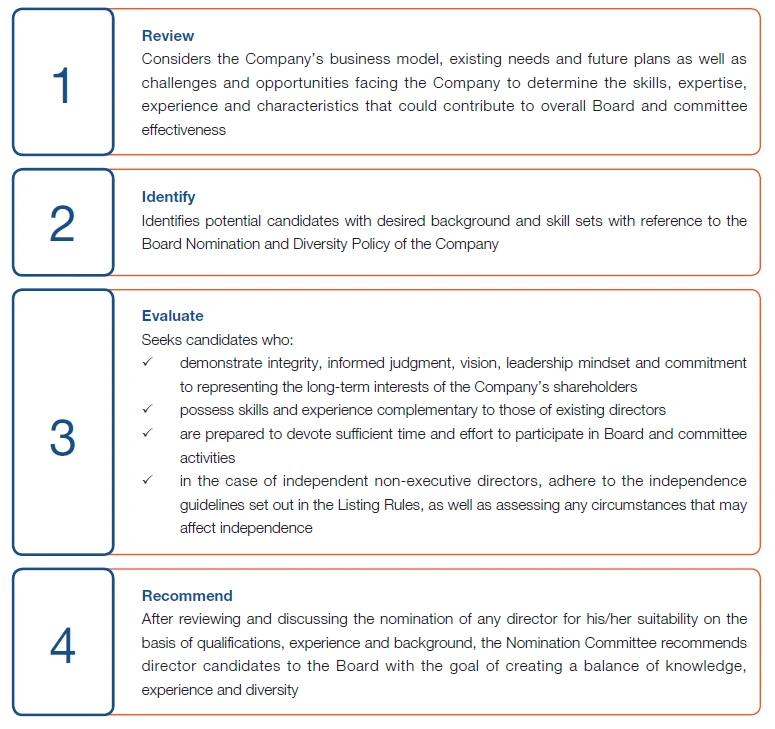

- Our Nomination Committee evaluates directors' perspectives in the context of our Company's evolving business and prioritizes diversity to ensure effective Board oversight. Recognizing that the selection of qualified directors is crucial to the long-term success of the Company, formal nomination procedures were adopted by the Board for governing the nomination of directors. Nomination Committee's process for identifying and recommending candidates are as follows:

Appointment

- The Board, having considered the recommendation from the Nomination Committee, will decide whether to approve the proposed appointment.

- For any person that is nominated for election as a director at the general meeting of the Company, the Nomination Committee and the Board will determine whether such candidate is qualified for directorship. Where appropriate, the Board will make recommendation to shareholders in respect of the proposed election of director(s) at the general meeting.

- None of the directors of the Company has a service contract which is not determinable by the Company within one year without payment of compensation (other than statutory compensation).

- All non-executive directors are appointed under fixed term of three years and are also subject to retirement on a rotational basis in accordance with the bye-laws of the Company.

Re-election

- The Nomination Committee will evaluate the re-electing directors based on the criteria as set out in the Board Nomination and Diversity Policy and make recommendations to the Board on the re-election and re-appointment of directors as appropriate, having regard to the profile of the director seeking re-election, the strategy of the Company and the structure, size and composition of the Board at the relevant time.

- The Board will consider whether to put forward the proposal for re-election of directors for shareholders' consideration.

-

- Newly appointed directors

All directors appointed to fill a casual vacancy on the Board or as an addition to the existing Board shall hold office only until the next annual general meeting of the Company and shall then be eligible for re-election at that meeting. - Existing directors

Any further re-appointment of an independent non-executive director, who has served the Board for more than nine years, will be subject to a separate resolution to be approved by the shareholders. The Nomination Committee and the Board consider the factors and discuss whether the proposed director is still considered independent.

- Newly appointed directors

Board Committees

- The Board delegates its powers and authorities from time to time to committees in order to ensure operational efficiency and specific issues are handled with relevant expertise.

- Each of the five board committees, namely, the Executive Committee, the Audit Committee, the Nomination Committee, the Remuneration Committee and the Environmental, Social and Governance Committee has its specific duties and authorities as set out in its own terms of reference, which are subject to review from time to time.

- Written terms of reference of each of the Audit Committee, the Nomination Committee and the Remuneration Committee are available on the website of each of the Hong Kong Stock Exchange and the Company pursuant to the requirements under the Listing Rules. Written terms of reference of the Environmental, Social and Governance Committee are available on the website of the Company.

- Regular board committee meetings were held during the year and the number of meetings and attendance of individual committee members are set out on page 56 of this annual report.

- All board committees are provided with sufficient resources to discharge their duties and are entitled to obtain independent legal or other professional advice at the Company’s expense.

Executive Committee

Major roles and functions

- to review the Group’s performance, direct its daily operations and manage its assets and liabilities within the authority granted by the Board

- to consider and approve transaction(s) of the Group which fall within the scope of general authorisation by the Board

- to make recommendations to the Board in respect of the overall strategy for the Group from time to time

Audit Committee

Major roles and functions

- to monitor the financial reporting process of the Company and to ensure its financial statements comply with relevant accounting standards

- to review the Company’s financial control, risk management and internal control systems, internal audit function and arrangements under the Company’s “Whistleblowing Policy”

- to govern the engagement of external auditor and its performance and independence

Nomination Committee

Major roles and functions

- to review the structure, size and composition (including the skills, knowledge and experience) of the Board, including from the aspect of diversity

- to identify qualified individuals and to make recommendations to the Board on the appointment or re-appointment of directors

Remuneration Committee

Major roles and functions

- to review and make recommendations to the Board on the Company’s policy and structure for remuneration of directors and senior management and on the establishment of a formal and transparent procedure for developing policy on such remuneration

- to make recommendations to the Board on the remuneration packages, including benefits in kind, pension rights and compensation payments, of individual directors

- to determine the remuneration packages of senior management

- to review and/or approve matters relating to share schemes

Environmental, Social and Governance Committee

Major roles and functions

- to develop, review, formulate and endorse ESG standards, priorities and goals of the Group, to advise the Board on the Group’s ESG approaches and practices, to review and evaluate the adequacy and effectiveness of Group- level frameworks of ESG and to develop, review and monitor the Company’s ESG policies, procedures and code of conduct

- to review the ESG-related training, education, and awareness programmes for employees, management and the Board

- to review and advise the Board on public reporting of the Company as regards its performance on ESG matters

- to oversee strategic plans for philanthropic initiatives, defining priority focus areas, target outcomes and methods for evaluating the impact of charitable contributions

- to develop and review the Company’s policies and practices on corporate governance and to make recommendations to the Board

- to review and monitor the training and continuous professional development of directors and senior management of the Company

- to review and monitor the Company’s policies and practices on compliance with legal and regulatory requirements

- The Company’s directors acknowledge their responsibilities to prepare accounts for each half and full financial year which give a true and fair view of the state of affairs of the Group. The directors consider that in preparing financial statements, the Group ensures statutory requirements are met, applies appropriate accounting policies that are consistently adopted and makes judgements and estimates that are reasonable and prudent in accordance with the applicable accounting standards.

- The directors are responsible for taking all reasonable and necessary steps to safeguard the assets of the Group and to prevent and detect fraud and other irregularities within the Group. They consider that the Group has adequate resources to continue in operational existence for the foreseeable future and are not aware of material uncertainties in relation to events or conditions that may cast significant doubt upon the Company’s ability to continue as a going concern. The Group’s financial statements have accordingly been prepared on a going concern basis.

- The directors are responsible for ensuring that proper accounting records are kept so that the Group can prepare financial statements in accordance with statutory requirements and the Group’s accounting policies. The Board is aware of the requirements under the applicable Listing Rules and statutory regulations with regard to the timely and proper disclosure of inside information, announcements and financial disclosures and authorizes their publication as and when required.

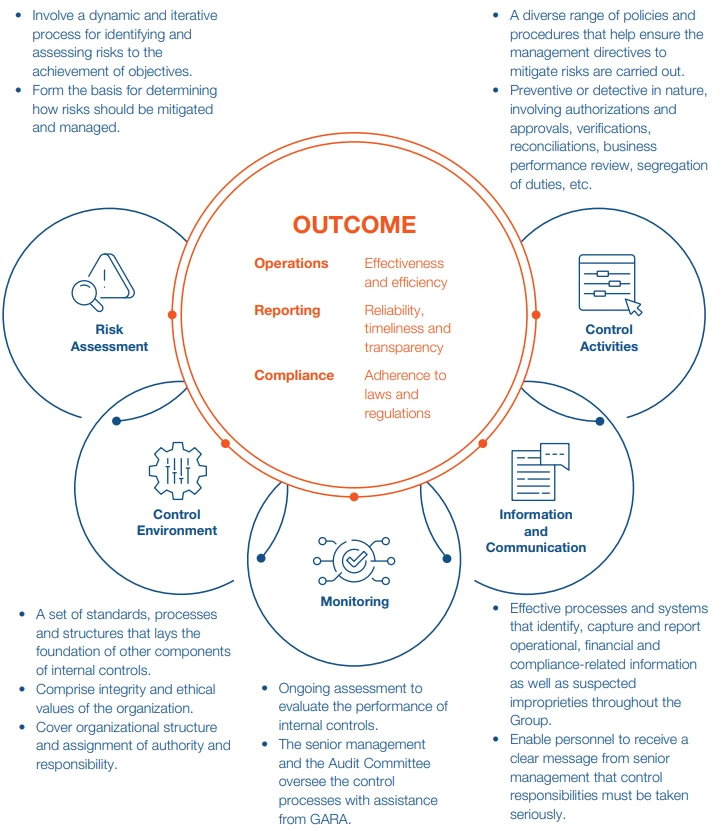

- Risk management and internal control are essential parts of corporate governance. With reference to the “Internal Control — Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”), ISO 31000 Risk Management Standard from International Organization for Standardization (“ISO”), and the “Internal Control and Risk Management — A Basic Framework” issued by HKICPA, the main features of our risk management and internal control systems are illustrated below:

Board Meeting

- The Board meets regularly at least four times a year at quarterly intervals and holds additional meetings as and when the Board thinks appropriate. Six Board meetings were held during FY2025.

- Notice of no less than 14 days was given to all directors for the regular Board meetings. Draft agendas for Board meetings were prepared by the Company Secretary and were circulated to all directors for comment before each meeting. Directors were given an opportunity to include any other matters in the agenda. As far as practicable, board papers were made available to the directors not less than three business days before the intended date of the Board meetings.

- Minutes of Board meetings were prepared by the Company Secretary with details of decisions reached, any concerns raised and dissenting views expressed. The draft minutes were sent to all directors within a reasonable time after each meeting for their comment before being formally signed by the chairman of the meeting. Final versions of minutes of the Board meetings were made available to the directors for information and record.

- At each regular Board meeting, executive directors of the Company or management made presentations to the Board on various aspects, including business performance, financial performance, corporate governance and outlook, etc.

- Throughout FY2025, directors of the Company also participated in the consideration and approval of matters of the Company by way of written resolutions circulated to them. Supporting written materials were provided in the circulation and verbal briefings were given by the subject executive directors or the Company Secretary when required.

- Pursuant to the bye-laws of the Company, a director, whether directly or indirectly, interested in a contract or arrangement or proposed contract or arrangement with the Company shall declare the nature of his/her interest at the meeting of the Board at which the question of entering into the contract or arrangement is first considered. Furthermore, a director shall not vote (nor be counted in the quorum) on any resolution of the Board approving any contract or arrangement or any other proposal in which he/she or any of his/her close associates is to his/her knowledge materially interested. Matters to be decided at Board meetings are decided by a majority of votes from directors entitled to vote. These bye-laws were strictly observed throughout FY2025.

Continuous Professional Development

- To facilitate fulfillment of directors’ duties and obligations, training is provided for directors to keep abreast of relevant knowledge and skills on an ongoing basis. According to the training records maintained by the Company, the Company has arranged the following training for directors during FY2025 in a manner that best fit their own circumstances:

.webp)

Director Induction

- Newly appointed directors are provided with orientation immediately upon his/her appointment that includes an overview of the Company’s business strategy and operations, financial condition, legal and regulatory framework and other relevant topics.

- They are also provided with a director’s manual containing a package of orientation materials on the operations and businesses of the Group, together with information relating to the duties and responsibilities of directors under regulatory requirements and the Listing Rules.

- The Board recognizes the importance of communication with the Company’s shareholders. A “Shareholders’ Communication Policy”, which is published on the Company’s website, was adopted by the Board for ensuring effective and transparent communication between the Company and its shareholders.

-

According to the Shareholders’ Communication Policy:

- corporate communications which contain regulatory disclosures and notices of the Company, are published in accordance with the legal and regulatory requirement applicable to the Company. Corporate communications and other general information concerning the Company and its businesses are posted on the corporate website (www.ctfs.com.hk) and/or distributed to the media as soon as practicable.

- shareholders are encouraged to participate in general meetings or to appoint proxies to attend and, on poll, vote at meetings for and on their behalf if they are unable to attend. The chairman of general meetings will allow reasonable time for shareholders to raise questions and comments during the meeting.

- the Company’s investor relations team, comprising executive directors and members of senior management, regularly arranges or participates in one-on-one meetings, roadshows, conferences, forums, site visits and briefing sessions to maintain an open dialogue with financial analysts and institutional investors in Hong Kong and overseas.

- for the purpose of enhancing effective communications, all shareholders are encouraged to send their enquiries and views on various matters affecting the Company by email to the Group Investor Relations Department of the Company at ir@ctfs.com.hk.

-

To ensure all shareholders have equal and timely access to important company information, the Company makes extensive use of the Company’s website to deliver up-to-date information. Latest information regarding the activities and publications of the Group, including financial reports, policies on corporate governance and ESG matters, media resources as well as presentations and webcasts delivered by management are readily accessible on the Company’s website at www.ctfs.com.hk.

-

The Company’s annual report is printed in both English and Chinese and is available on the Company’s website. Shareholders may at any time change their choice of means of receiving the Company’s corporate communications free of charge by notice in writing to the Company’s branch share registrar in Hong Kong, Tricor Investor Services Limited. With effect from 1 January 2025, the Company’s branch share registrar and transfer office in Hong Kong has been changed from Tricor Standard Limited to Tricor Investor Services Limited. For more details, please refer to the Company’s announcement dated 19 December 2024.

Shareholders’ Rights

-

The Board and management shall ensure shareholders’ rights and all shareholders are treated equitably and fairly. Pursuant to the Company’s bye-laws, any shareholder entitled to attend and vote at a general meeting of the Company is entitled to appoint another person as his/her proxy to attend and vote instead of him/her. Shareholders who hold not less than one-tenth of the paid up capital of the Company shall have the right, by written requisition to the Board or the Company Secretary, to require a special general meeting to be called by the Board for the transaction of any business specified in such requisition.

-

The procedures for shareholders to put forward proposals at general meetings are stated as follows:

-

The written requisition must state the purposes of the meeting, and must be signed by all the shareholders concerned and may consist of several documents in like form each signed by one or more shareholders concerned.

-

The written requisition must be deposited at the Company’s registered office in Bermuda as well as the principal place of business in Hong Kong at 21/F, NCB Innovation Centre, 888 Lai Chi Kok Road, Cheung Sha Wan, Kowloon, Hong Kong for the attention of the Company Secretary.

-

The written requisition will be verified with the Company’s branch share registrar and upon their confirmation that the request is proper and in order, the Company Secretary will ask the Board to include the relevant resolution in the agenda for such general meeting provided that the shareholders concerned have deposited a sum of money reasonably sufficient to meet the Company’s expenses in serving the notice of the resolution and circulating the statement submitted by the shareholders concerned in accordance with the statutory requirements to all the registered shareholders. Such general meeting shall be held within two months after deposit of such requisition.

-

If within 21 days of such deposit, the Board fails to proceed to convene such general meeting, the shareholders concerned, or any of them representing more than one half of the total voting rights of all of them, may themselves convene a meeting, but any meeting so convened shall not be held after the expiration of three months from the said date.

-

-

Chairman of each of the board committees, or failing the Chairman, any member from the respective committees, must attend the annual general meetings of the Company to address shareholders’ queries. External auditor is also invited to attend the Company’s annual general meetings and is available to assist the directors in addressing queries from shareholders relating to the conduct of the audit, the preparation and content of its auditor’s report, the accounting policies and auditor independence.