CTFS Announces FY2025 Annual Results

- Prudent Planning for Sustainable Growth -

24.09.2025

(24 September 2025, Hong Kong) CTF Services Limited (the “Company” and its subsidiaries, collectively, “CTFS” or the “Group”; Hong Kong stock code: 659) today announced its final results for the year ended 30 June 2025 (“FY2025”).

HIGHLIGHTS

Mr. Brian Cheng, Executive Director and Group Co-Chief Executive Officer of CTFS, said, “Leveraging its diversified business portfolio, CTFS has consistently demonstrated resilience amid macroeconomic uncertainties. The Group delivered solid results, driven by strong growth in the Insurance segment, which has been renamed as the ‘Financial Services’ segment to reflect its broadened strategic scope. In response to rising market demand for comprehensive financial services, in particular wealth management, we are actively scaling this high-potential business area. The acquisitions of uSMART, a technology-driven financial service company, and Blackhorn, an external asset manager, mark significant milestones in our strategic roadmap. Accelerating the development of our Financial Services segment and leveraging the cohesive synergy with Chow Tai Fook Group, strengthening our capability to offer a more integrated and diversified suite of financial solutions, differentiating us from competitors.”

Mr. Gilbert Ho, Executive Director and Group Co-Chief Executive Officer of CTFS, added, “The Group’s resilient performance underscores our ability to create long-term value for shareholders amid a challenging economic environment. We will continue to strategically optimize our business portfolio to pursue opportunities that aligned with our growth strategies and stable cashflow generation objective, supported by disciplined capital allocation and prudent financial management. Looking ahead, the Group will continue to leverage its agility, financial strength, and operational discipline to capture emerging opportunities, strengthen portfolio resilience, and deliver sustainable value to stakeholders.”

Proactive and Strategic Financial Management

Healthy debt profile to navigate market volatility

The Group maintains a healthy financial position. The Group successfully reduced its average borrowing costs to approximately 4.1% (FY2024: 4.7%) per annum in FY2025. Since 2023, the Group has strategically shifted a substantial portion of its debt portfolio toward lower-cost Renminbi (“RMB”) borrowings, serving as a natural hedge against RMB-denominated assets to mitigate the impact of potential RMB depreciation against the Hong Kong Dollar and reducing borrowing cost amid a higher-for-longer United States interest rate environment. As at 30 June 2025, the Group’s net gearing ratio stood at a healthy level of 37%.

Optimization of Businesses

Strategically optimize its business portfolio to capture high-growth opportunities

Acquisitions:

- Construction: Completed acquisition of Hsin Chong Aster Building Services Limited (“Hsin Chong Aster”), a leading electrical and mechanical engineering services contractor (March 2025)

- Financial Services: Announced acquisition of 43.93% interest in uSmart Inlet Group Limited (“uSMART”), a leading technology-driven financial services company (March 2025)

- Financial Services: Announced acquisition of 65% interest in Blackhorn Group Limited (“Blackhorn”), an external asset manager (August 2025)

Divestments:

- Completed the sale of its Free Duty business (December 2024)

- Joint venture entity divested its entire stake in Hyva III B.V. and its subsidiaries (January 2025)

- Sold the Group’s 40% interest in ForVEI II S.r.l., which operated solar power assets in Italy (May 2025)

Business Performance Highlights

Roads

A stable performance despite a challenging environment

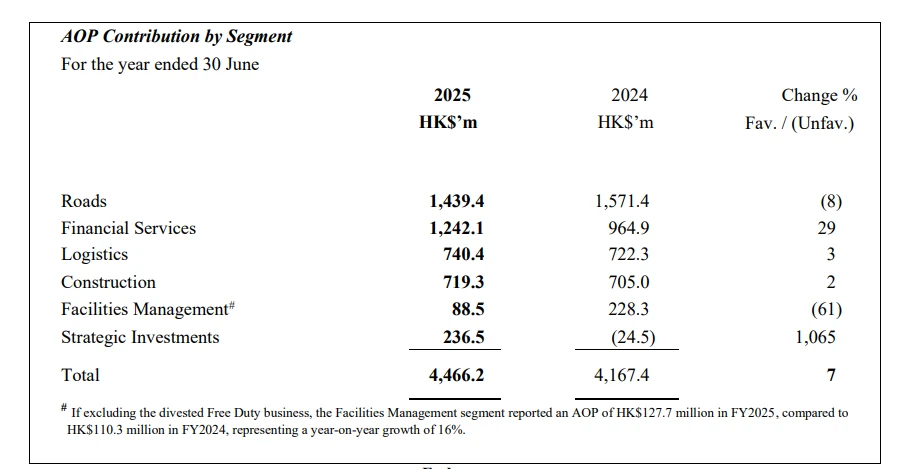

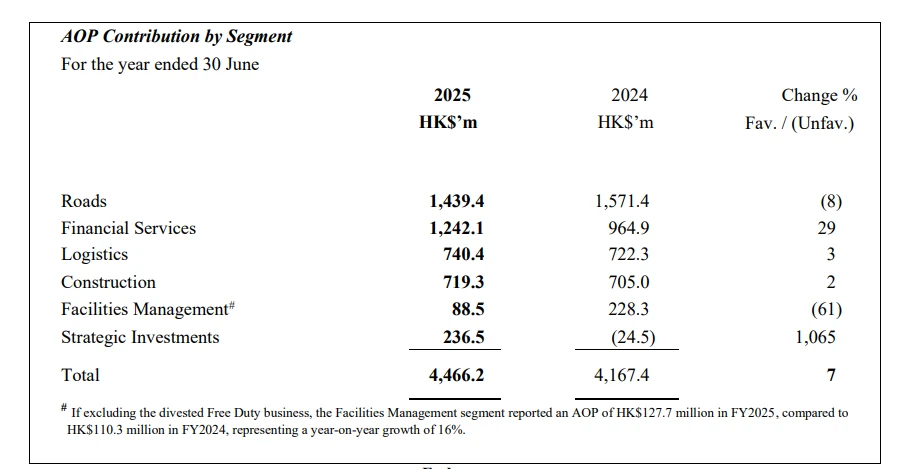

In FY2025, overall like-for-like average daily traffic flow increased by 2% year-on-year, while like-for-like average daily toll revenue declined by 2% year-on-year. A total AOP of the segment amount to HK$1,439.4 million, representing a year-on-year decline of 8%. The decrease was primarily attributable to the expiry of the concession for Guangzhou City Northern Ring Road in March 2024 and slower-than-expected traffic recovery and intensified competition across certain road projects. Excluding the impact of the concession expiry of Guangzhou City Northern Ring Road and 3 toll roads in Shanxi Province, the AOP from 13 toll roads with full year profit contributions recorded a year-on-year increase of 1%. As at 30 June 2025, the overall average remaining concession period of the Group’s road portfolio was approximately 12 years.

Financial Services

CTF Life: Noticeable AOP and CSM achievement

In FY2025, the Financial Services segment delivered a strong performance, with AOP surging by 29% year-on-year to HK$1,242.1 million, driven by the robust growth of Chow Tai Fook Life Insurance Company Limited (“CTF Life”) . Supported by profitable business growth and favourable financial market movements, the Contractual Service Margin (“CSM”) release from the insurance business rose by 28% year-on-year to HK$1,130.1 million.

CTF Life has been proactively strengthening its agency force, resulting in a 48% year-on-year increase in Annual Premium Equivalent (“APE”) through the agency channel. A 48% uplift in agency productivity by APE and a 24% rise in new recruits were recorded. The agency’s persistency ratio also improved by 23%. Nonetheless, due to an exceptionally strong performance in FY2024 driven by the post-COVID-19 rebound, as well as intensified competition in the brokerage channel, the Group recorded a decline in overall APE. Although Value of New Business (“VONB”) margin improved from 27% in FY2024 to 30% in FY2025, VONB declined by 18% to HK$1,003.3 million in FY2025, primarily due to the slowdown in APE.

CTF Life maintained a resilient financial position in FY2025. An inaugural dividend of approximately HK$0.5 billion was distributed. The solvency ratio under the Hong Kong Risk Based Capital (“HKRBC”) regime remained robust at 279% as at 30 June 2025, significantly exceeding the minimum regulatory requirement of 100%. Embedded value surged by 19% to HK$25.3 billion as at 30 June 2025. In the first three months of 2025, CTF Life ranked 11th among life insurers in Hong Kong by APE, maintaining a competitive market position.

Logistics

Strategic Positioning of the Group’s Logistics Assets Portfolio

In FY2025, the Logistics segment delivered a year-on-year AOP increase of 3%, reaching HK$740.4 million. The modest growth in the Logistics segment was underpinned by stable performance from ATL Logistics Centre Hong Kong Limited (“ATL”) and a substantial surge in contributions from China United International Rail Containers Co., Limited (“CUIRC”).

The Group has strategically rebranded the warehouse business as ‘CTF Logistics’ to capitalize on the strong brand equity of “Chow Tai Fook”, generating greater synergies across the Logistics segment. The logistics asset and management portfolio comprises ATL and 7 logistics properties in the Mainland.

As at 30 June 2025, ATL recorded a year-on-year average rental growth of 8%, with an occupancy rate of 80.7% (30 June 2024: 96.3%). The average occupancy rate across the 7 logistics properties in the Mainland was 87.5% (30 June 2024: 87.4%). In response to current market dislocation, the Group is actively identifying and securing undervalued logistics opportunities in the Mainland, with a particular focus on premium warehouse assets which are already in operation in the Greater Bay Area and the Yangtze River Delta.

Benefiting from the strong support of the government of the People’s Republic of China for the development of rail transportation and the growing demand for multimodal transportation services, CUIRC delivered robust operational performance in FY2025. Operating 13 strategically located railway container terminals in the Mainland, CUIRC reported a year-on-year uptick in AOP of 23%, with throughput rising 10% to 7,000,000 TEUs during the year.

Construction

Delivered Resilient Results—Backed by a Proven Track Record

CTFS Construction Group comprises four well-established specialist entities: Hip Hing Group, Vibro Group, Quon Hing Group, and Hsin Chong Aster, which was acquired in March 2025. In FY2025, CTFS Construction Group delivered resilient performance, maintaining a steady AOP of HK$719.3 million, despite headwinds from a softer project pipeline and rising material costs.

As at 30 June 2025, the gross value of contracts on hand stood at approximately HK$58.5 billion. The remaining works to be completed amounted to approximately HK$38.5 billion, representing a 24% increase compared to 30 June 2024. Newly awarded contracts rose by 9% year-on-year to approximately HK$23.9 billion, significantly outperforming the broader market. Key projects awarded during FY2025 included AsiaWorld-Expo Phase 2 development and Building 1 Development of Hong Kong-Shenzhen Innovation and Technology Park.

Facilities Management

Consistent progress

In FY2025, excluding the divested Free Duty business, the Facilities Management segment delivered a year-on-year AOP increase of 16% to HK$127.7 million. This performance was primarily driven by continued progress of Gleneagles Hospital Hong Kong (“GHK”), which successfully passed its ramp-up phase and began contributing positively to the Group’s profitability during the current financial year.

GHK recorded its first-time positive AOP contribution since opening. Revenue recorded solid growth, with EBITDA surged by 23% year-on-year, accompanied by further improvement in EBITDA margin. Patient volumes continued to rise, with strong performance in inpatients services revenue. As at 30 June 2025, the number of regularly utilized beds reached 337 (30 June 2024: 313), with an average occupancy rate of 64% (30 June 2024: 65%).

In line with GHK’s strategic development roadmap, the hospital, together with Parkway Medical Services (Hong Kong) Limited, a business venture between the Group and IHH Healthcare Berhad, continues to expand their healthcare network including specialized services. With four new service stations launched this financial year, a total of ten service outlets are currently in operation. A new Gleneagles MediCentre is scheduled to open in Admiralty in the fourth quarter of 2025 to deliver a broader range of services to meet evolving customer needs.

Hong Kong Convention and Exhibition Centre (“HKCEC”) continues to strengthen its position as Asia’s premier events hub by hosting a diverse portfolio of events. In FY2025, total attendance increased by 7% year-on-year, reaching approximately 7.8 million across 786 events (FY2024: 823 events).

Kai Tak Sports Park Limited (“KTSPL”), in which the Group holds a 25% interest, recorded an Attributable Operating Loss (“AOL”) due to pre-operational expenses. Since its inauguration in March 2025, KTSP has successfully hosted more than 30 local and international sports, entertainment and community events, attracting over one million visitors to the Kai Tak Stadium, further enhancing Hong Kong’s position as “Asia’s Event Capital”. The 700,000-square-foot retail mall, achieved an occupancy rate of over 80% as at 30 June 2025.

Outlook

The Group remains focused on segments with strong growth potential, particularly in financial services and logistics. In response to rapid market changes, the Group continues to evolve with the times, adopting flexible operating strategies and a prudent investment approach to capture opportunities that offer stable cash flow and long-term growth momentum. At the same time, the Group remains committed to disciplined capital management and maintaining healthy liquidity, to create sustainable value for stakeholders and all shareholders.

HIGHLIGHTS

- Overall Attributable Operating Profit (AOP) increased by 7%, reaching HK$4,466.2 million.

- The profit attributable to shareholders of the Company grew by 4% to HK$2,162.0 million.

- The Group’s financial position remained healthy. Total available liquidity stood at approximately HK$29.8 billion as at 30 June 2025, comprising cash and bank balances of approximately HK$20.2 billion and unutilized committed banking facilities of approximately HK$9.6 billion.

- The Group’s net gearing ratio stood at a healthy level of 37%.

- Committed to sustainable and progressive dividend policy:

- Proposed final ordinary dividend of HK$0.35 per share, with scrip dividend available.

- Together with the interim ordinary dividend of HK$0.30 per share, total ordinary dividends for FY2025 will be HK$0.65 per share. (FY2024: total ordinary dividends of HK$0.65 per share)

- Coupled with a one-off special dividend of HK$0.30 per share, which was distributed concurrently with the interim ordinary dividend in FY2025, the total dividend distribution for FY2025 will be HK$0.95 per share.

- The Board has proposed a bonus issue of shares on the basis of one bonus share for every Ten existing shares held by the Shareholders to express appreciation for shareholder support and create long-term value.

Mr. Brian Cheng, Executive Director and Group Co-Chief Executive Officer of CTFS, said, “Leveraging its diversified business portfolio, CTFS has consistently demonstrated resilience amid macroeconomic uncertainties. The Group delivered solid results, driven by strong growth in the Insurance segment, which has been renamed as the ‘Financial Services’ segment to reflect its broadened strategic scope. In response to rising market demand for comprehensive financial services, in particular wealth management, we are actively scaling this high-potential business area. The acquisitions of uSMART, a technology-driven financial service company, and Blackhorn, an external asset manager, mark significant milestones in our strategic roadmap. Accelerating the development of our Financial Services segment and leveraging the cohesive synergy with Chow Tai Fook Group, strengthening our capability to offer a more integrated and diversified suite of financial solutions, differentiating us from competitors.”

Mr. Gilbert Ho, Executive Director and Group Co-Chief Executive Officer of CTFS, added, “The Group’s resilient performance underscores our ability to create long-term value for shareholders amid a challenging economic environment. We will continue to strategically optimize our business portfolio to pursue opportunities that aligned with our growth strategies and stable cashflow generation objective, supported by disciplined capital allocation and prudent financial management. Looking ahead, the Group will continue to leverage its agility, financial strength, and operational discipline to capture emerging opportunities, strengthen portfolio resilience, and deliver sustainable value to stakeholders.”

Proactive and Strategic Financial Management

Healthy debt profile to navigate market volatility

The Group maintains a healthy financial position. The Group successfully reduced its average borrowing costs to approximately 4.1% (FY2024: 4.7%) per annum in FY2025. Since 2023, the Group has strategically shifted a substantial portion of its debt portfolio toward lower-cost Renminbi (“RMB”) borrowings, serving as a natural hedge against RMB-denominated assets to mitigate the impact of potential RMB depreciation against the Hong Kong Dollar and reducing borrowing cost amid a higher-for-longer United States interest rate environment. As at 30 June 2025, the Group’s net gearing ratio stood at a healthy level of 37%.

Optimization of Businesses

Strategically optimize its business portfolio to capture high-growth opportunities

Acquisitions:

- Construction: Completed acquisition of Hsin Chong Aster Building Services Limited (“Hsin Chong Aster”), a leading electrical and mechanical engineering services contractor (March 2025)

- Financial Services: Announced acquisition of 43.93% interest in uSmart Inlet Group Limited (“uSMART”), a leading technology-driven financial services company (March 2025)

- Financial Services: Announced acquisition of 65% interest in Blackhorn Group Limited (“Blackhorn”), an external asset manager (August 2025)

Divestments:

- Completed the sale of its Free Duty business (December 2024)

- Joint venture entity divested its entire stake in Hyva III B.V. and its subsidiaries (January 2025)

- Sold the Group’s 40% interest in ForVEI II S.r.l., which operated solar power assets in Italy (May 2025)

Business Performance Highlights

Roads

A stable performance despite a challenging environment

In FY2025, overall like-for-like average daily traffic flow increased by 2% year-on-year, while like-for-like average daily toll revenue declined by 2% year-on-year. A total AOP of the segment amount to HK$1,439.4 million, representing a year-on-year decline of 8%. The decrease was primarily attributable to the expiry of the concession for Guangzhou City Northern Ring Road in March 2024 and slower-than-expected traffic recovery and intensified competition across certain road projects. Excluding the impact of the concession expiry of Guangzhou City Northern Ring Road and 3 toll roads in Shanxi Province, the AOP from 13 toll roads with full year profit contributions recorded a year-on-year increase of 1%. As at 30 June 2025, the overall average remaining concession period of the Group’s road portfolio was approximately 12 years.

Financial Services

CTF Life: Noticeable AOP and CSM achievement

In FY2025, the Financial Services segment delivered a strong performance, with AOP surging by 29% year-on-year to HK$1,242.1 million, driven by the robust growth of Chow Tai Fook Life Insurance Company Limited (“CTF Life”) . Supported by profitable business growth and favourable financial market movements, the Contractual Service Margin (“CSM”) release from the insurance business rose by 28% year-on-year to HK$1,130.1 million.

CTF Life has been proactively strengthening its agency force, resulting in a 48% year-on-year increase in Annual Premium Equivalent (“APE”) through the agency channel. A 48% uplift in agency productivity by APE and a 24% rise in new recruits were recorded. The agency’s persistency ratio also improved by 23%. Nonetheless, due to an exceptionally strong performance in FY2024 driven by the post-COVID-19 rebound, as well as intensified competition in the brokerage channel, the Group recorded a decline in overall APE. Although Value of New Business (“VONB”) margin improved from 27% in FY2024 to 30% in FY2025, VONB declined by 18% to HK$1,003.3 million in FY2025, primarily due to the slowdown in APE.

CTF Life maintained a resilient financial position in FY2025. An inaugural dividend of approximately HK$0.5 billion was distributed. The solvency ratio under the Hong Kong Risk Based Capital (“HKRBC”) regime remained robust at 279% as at 30 June 2025, significantly exceeding the minimum regulatory requirement of 100%. Embedded value surged by 19% to HK$25.3 billion as at 30 June 2025. In the first three months of 2025, CTF Life ranked 11th among life insurers in Hong Kong by APE, maintaining a competitive market position.

Logistics

Strategic Positioning of the Group’s Logistics Assets Portfolio

In FY2025, the Logistics segment delivered a year-on-year AOP increase of 3%, reaching HK$740.4 million. The modest growth in the Logistics segment was underpinned by stable performance from ATL Logistics Centre Hong Kong Limited (“ATL”) and a substantial surge in contributions from China United International Rail Containers Co., Limited (“CUIRC”).

The Group has strategically rebranded the warehouse business as ‘CTF Logistics’ to capitalize on the strong brand equity of “Chow Tai Fook”, generating greater synergies across the Logistics segment. The logistics asset and management portfolio comprises ATL and 7 logistics properties in the Mainland.

As at 30 June 2025, ATL recorded a year-on-year average rental growth of 8%, with an occupancy rate of 80.7% (30 June 2024: 96.3%). The average occupancy rate across the 7 logistics properties in the Mainland was 87.5% (30 June 2024: 87.4%). In response to current market dislocation, the Group is actively identifying and securing undervalued logistics opportunities in the Mainland, with a particular focus on premium warehouse assets which are already in operation in the Greater Bay Area and the Yangtze River Delta.

Benefiting from the strong support of the government of the People’s Republic of China for the development of rail transportation and the growing demand for multimodal transportation services, CUIRC delivered robust operational performance in FY2025. Operating 13 strategically located railway container terminals in the Mainland, CUIRC reported a year-on-year uptick in AOP of 23%, with throughput rising 10% to 7,000,000 TEUs during the year.

Construction

Delivered Resilient Results—Backed by a Proven Track Record

CTFS Construction Group comprises four well-established specialist entities: Hip Hing Group, Vibro Group, Quon Hing Group, and Hsin Chong Aster, which was acquired in March 2025. In FY2025, CTFS Construction Group delivered resilient performance, maintaining a steady AOP of HK$719.3 million, despite headwinds from a softer project pipeline and rising material costs.

As at 30 June 2025, the gross value of contracts on hand stood at approximately HK$58.5 billion. The remaining works to be completed amounted to approximately HK$38.5 billion, representing a 24% increase compared to 30 June 2024. Newly awarded contracts rose by 9% year-on-year to approximately HK$23.9 billion, significantly outperforming the broader market. Key projects awarded during FY2025 included AsiaWorld-Expo Phase 2 development and Building 1 Development of Hong Kong-Shenzhen Innovation and Technology Park.

Facilities Management

Consistent progress

In FY2025, excluding the divested Free Duty business, the Facilities Management segment delivered a year-on-year AOP increase of 16% to HK$127.7 million. This performance was primarily driven by continued progress of Gleneagles Hospital Hong Kong (“GHK”), which successfully passed its ramp-up phase and began contributing positively to the Group’s profitability during the current financial year.

GHK recorded its first-time positive AOP contribution since opening. Revenue recorded solid growth, with EBITDA surged by 23% year-on-year, accompanied by further improvement in EBITDA margin. Patient volumes continued to rise, with strong performance in inpatients services revenue. As at 30 June 2025, the number of regularly utilized beds reached 337 (30 June 2024: 313), with an average occupancy rate of 64% (30 June 2024: 65%).

In line with GHK’s strategic development roadmap, the hospital, together with Parkway Medical Services (Hong Kong) Limited, a business venture between the Group and IHH Healthcare Berhad, continues to expand their healthcare network including specialized services. With four new service stations launched this financial year, a total of ten service outlets are currently in operation. A new Gleneagles MediCentre is scheduled to open in Admiralty in the fourth quarter of 2025 to deliver a broader range of services to meet evolving customer needs.

Hong Kong Convention and Exhibition Centre (“HKCEC”) continues to strengthen its position as Asia’s premier events hub by hosting a diverse portfolio of events. In FY2025, total attendance increased by 7% year-on-year, reaching approximately 7.8 million across 786 events (FY2024: 823 events).

Kai Tak Sports Park Limited (“KTSPL”), in which the Group holds a 25% interest, recorded an Attributable Operating Loss (“AOL”) due to pre-operational expenses. Since its inauguration in March 2025, KTSP has successfully hosted more than 30 local and international sports, entertainment and community events, attracting over one million visitors to the Kai Tak Stadium, further enhancing Hong Kong’s position as “Asia’s Event Capital”. The 700,000-square-foot retail mall, achieved an occupancy rate of over 80% as at 30 June 2025.

Outlook

The Group remains focused on segments with strong growth potential, particularly in financial services and logistics. In response to rapid market changes, the Group continues to evolve with the times, adopting flexible operating strategies and a prudent investment approach to capture opportunities that offer stable cash flow and long-term growth momentum. At the same time, the Group remains committed to disciplined capital management and maintaining healthy liquidity, to create sustainable value for stakeholders and all shareholders.

PDF